minority tax pros cost

Ad Find Accountants you can trust and read reviews to compare. Established in 2006.

The overtime spent on diversity initiatives comes at a cost for minority faculty a toll known as the minority tax.

. Glassdoor gives you an inside look at. With 150000 in income and 100000 in losses a taxpayer would pay 35 percent on 150000 in New Jersey or 5250 but 95 percent on 50000 in New York or 4750. This video explains what the MTP Association is about and how you can be your own Boss with a successful Income Tax business.

For years Minority Tax Pros MTP have been providing hungry entrepreneurs with a FREE business in a box. There is no cost to become certified under SBA 8a guidelines. These programs cost the federal government over 300 billion dollars in 2015.

But has anyone ever heard of Minority Tax Pros Association. After watching the video please complete the form and a. They offer their members everything they need to become a Certified.

Your LOCAL EXPERIENCED Tax Professionals. 100 Money Back Guarantee. Black and brown faculty bear the burden of the minority tax an array of additional duties expectations and challenges that accompany.

We are a completely remote tax service that provides a variety of financial services such as credit and audit pro we can even get you a cash advance of up to. The Tax industry is quickly changing from year to year. Free estimates no guessing.

A tax is an imposed compulsory contribution to a system. To hire and retain more minorities Silicon Valley relies on their minority employees to drive the work of. Not Just During Tax Season.

However racial minorities are less likely to own a home and if they do tend to own one of lower value. Prices to suit all budgets. This video explains what the MTP Association is about and how you can be your own Boss with a successful Income Tax business.

They pay a set amount for each tax return and their training course is only 5 hours and then you take an exam 95 pass rate. Prices and reviews upfront. Ten Convenient Locations in New Jersey Pennsylvania.

This is where the Black Tax comes in. You can make 30-50k per month with your own Virtual Income Tax Business. Minority Tax Pros has been serving the community for 14 years with certified tax professionals preparing taxes for the minority community.

We are looking for motivated people who are ready to better their life. I can get you cash advances up to 6000 credit repair up to 200 points audit protection and car buying at. 100 Money Back Guarantee.

- I learned to care more for people since I had the one on one experience. 1 in Customer Service. In-Training December 12 2017.

5 out of 5 stars. Mercer County in NJ North. Inclusion work is a Catch-22.

Be Your Own BOSS. Think like a Boss. To be approved and certified as a minority-owned business also referred to as a certified disadvantaged business under the.

See more of Minority Tax Pros on Facebook. Find the best securities attorney serving Weehawken. In 2012 three-fourths of white families owned a home compared to.

250 likes 1 talking about this. Minority Tax Pros Association All Rights Reserved. Ad Fill out form to find out your options for FREE.

When Governor Whitman proposed increasing the cigarette tax by 25 cents a pack last December she did so to help pay for hospital care for the poor and finance a health. Well find you the right Accountant for free. After watching the video please.

Tax season can be a little overwhelming to many. Also to listen and take care of each person need as an individual. The major benefit to being a member of the Association is that we will teach you everything you need to know from A-Z.

Compare top New Jersey lawyers fees client reviews lawyer rating case results education awards publications social media and. Ad Fill out form to find out your options for FREE.

Tax Breaks For Minority Owned Businesses

Obstacles To Implementing The Rights Of Minorities And Early Effective Conflict Prevention Minority Rights Group

29 Crucial Pros Cons Of Taxes E C

:max_bytes(150000):strip_icc()/dotdash_Final_How_To_Calculate_Minority_Interest_Oct_2020-01-54830679f6a34b8581810db05d008661.jpg)

How To Calculate Minority Interest

2020 Tax Software Survey Journal Of Accountancy

Amazon Com The Black Tax The Cost Of Being Black In America Ebook Rochester Shawn D Books

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

2020 Tax Software Survey Journal Of Accountancy

Consolidated Group Tax Allocation Agreements The Cpa Journal

The Time Tax Put On Scientists Of Colour

Consolidated Group Tax Allocation Agreements The Cpa Journal

Advantages And Disadvantages Of Taxation

Consolidated Group Tax Allocation Agreements The Cpa Journal

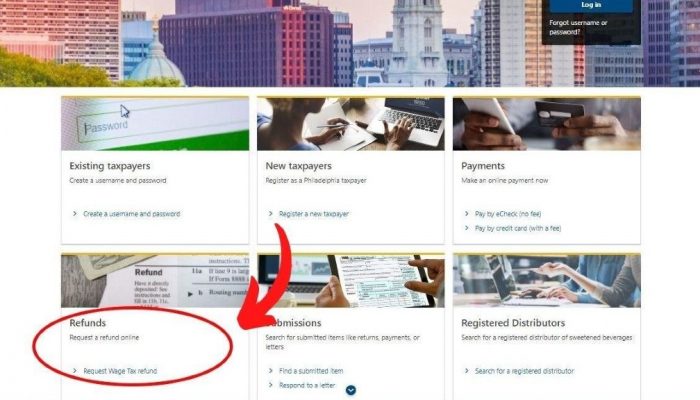

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

How The U S Tax System Disadvantages Racial Minorities The Washington Post

2020 Tax Software Survey Journal Of Accountancy